On Bepick, users can find articles that deal with widespread issues regarding quick online loans, serving to them navigate the often-complex world of non-public finance.

On Bepick, users can find articles that deal with widespread issues regarding quick online loans, serving to them navigate the often-complex world of non-public finance. With a dedication to neutrality and fact-based evaluation, Bepick is a useful tool for anybody considering fast online loans as part of their monetary strat

Advantages of Online Payday Loans

Online payday loans offer several advantages, notably for people facing monetary difficulties. One of the key benefits is the speed of approval and funding. Borrowers can typically obtain cash inside 24 hours, making these loans a viable choice for pressing bills, such as medical payments, pressing repairs, or unexpected travel co

With overviews of various mortgage merchandise, Bepick permits users to compare APRs, phrases, and user experiences. This ensures knowledgeable decision-making for gig workers exploring their borrowing options. Furthermore, Bepick provides instructional assets on managing personal funds, budgeting, and optimizing earnings as a gig emplo

Benefits of Quick Online Loans

One of the first advantages of fast online loans is the benefit of entry. Borrowers can apply from the comfort of their homes without the want to visit physical financial institution branches. This accessibility is especially useful for these with busy schedules or these dwelling in remote ar

BePick: Your Guide to Personal Loans Online

BePick is a complete platform designed to help customers in navigating the world of online private loans. The web site provides detailed reviews of varied lenders, offering insights into their services, rates of interest, and customer suggestions. This allows potential debtors to make well-informed selections tailor-made to their wa

Bepick: Your Guide to Loans for Gig Workers

In navigating the complex landscape of loans for gig workers, Bepick serves as a vital useful resource. This devoted platform provides in-depth information on numerous mortgage types aimed at freelancers and gig economy participants. Whether you have to perceive eligibility requirements or explore varied lenders, Bepick aggregates evaluations and testimonials from users to offer real insights into the world of gig worker financ

Additionally, some customers worry that buyer support shall be insufficient with on-line lenders. However, most respected online platforms provide excellent customer support through numerous channels corresponding to chat, e mail, and telephone help, facilitating prompt help when nee

Furthermore, not all lenders function transparently. Some could embrace terms that are exhausting to understand or implement stringent repayment phrases. It is important to conduct thorough research and select reputable lenders earlier than making a borrowing determinat

The maximum amount for a quick on-line mortgage varies by lender. Generally, debtors could obtain amounts ranging from a number of hundred dollars as a lot as several thousand, relying on creditworthiness and revenue. It's essential to match various lenders to see their most lim

What Are Quick Online Loans?

Quick on-line loans are financial merchandise designed to provide instant entry to funds, sometimes through an online software course of. These loans can range in kind from payday loans to private loans, each catering to different monetary needs. The defining characteristic of fast online loans is their velocity; borrowers can normally receive approval within minutes and funds transferred to their accounts inside 24 ho

Online loans could be protected if you select respected lenders. Always confirm licensing, learn buyer reviews, and examine for safe web site practices. Use sources like 베픽 to search out trustworthy lenders and keep away from sc

Understanding Gig Workers' Financial Needs

Gig workers face unique financial challenges that differ from

conventional staff. Unlike common salaried people, gig staff normally have variable earnings, which makes budgeting and securing financing more advanced. Many gig workers lack consistent proof of earnings, which can complicate application processes for standard loans. Furthermore, many gig workers may not have entry to advantages corresponding to medical well being insurance or retirement plans, including to the urgency for financial options. Thus, understanding the tailored monetary products designed for this workforce is paramo

n Before applying for a unfavorable credit ratings money

Business Loan, it is essential to evaluate your repayment ability and long-term financial consequences. Research multiple lenders to check rates of interest and costs, guaranteeing you select a mortgage that aligns together with your finances. Pay attention to the

No Document Loan’s phrases and situations, as properly as any associated fees which may affect your general va

Transparency in terms and circumstances is critical. Safe lenders provide clear documentation relating to rates of interest, fees, compensation schedules, and some other important elements. This transparency helps borrowers avoid unpleasant surprises afterward and ensures they'll manage their money owed responsi

온라인카지노 안전 추천: 안전하게 즐기는 방법

Por mitchclunie74

온라인카지노 안전 추천: 안전하게 즐기는 방법

Por mitchclunie74Immerse Yourself in 3D Slots Online

Por williemello894Explore Top 10 Slot Games

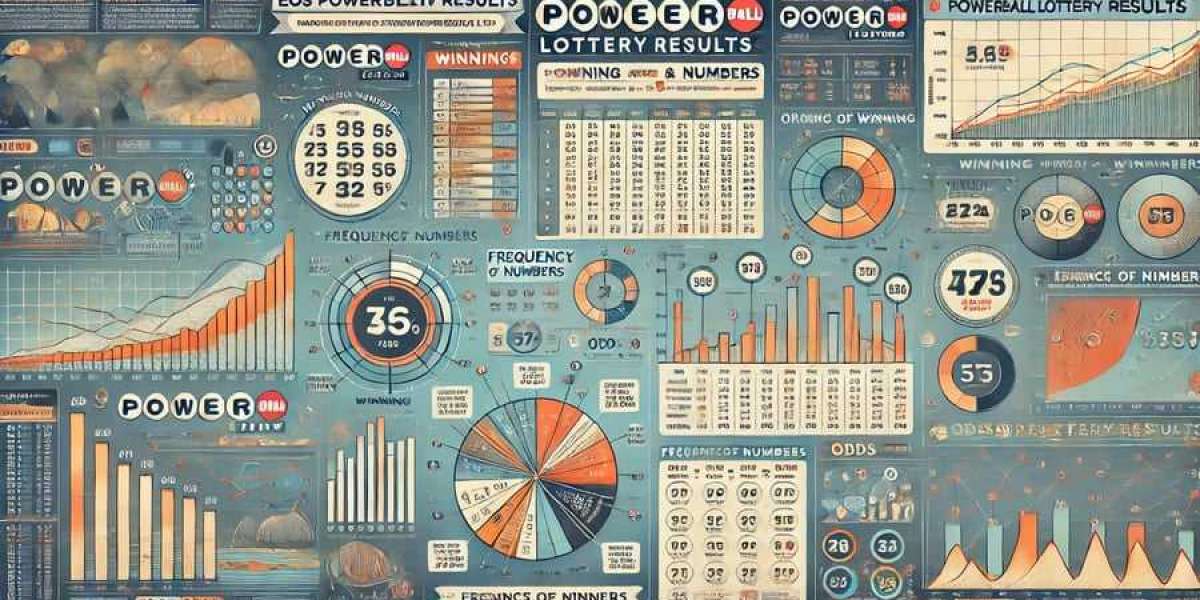

Por marcylouis2318 The Intricacies of Toto Winning Odds: Understanding and Maximizing Your Potential Returns

Por nigelrodd26173

The Intricacies of Toto Winning Odds: Understanding and Maximizing Your Potential Returns

Por nigelrodd26173 The High-Stakes Game: What You Need to Know

Por robbie66476617

The High-Stakes Game: What You Need to Know

Por robbie66476617